estate tax exemption 2022 proposal

A provision of the proposed legislation that would become effective Jan. The current lifetime exemption is 11700000.

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse.

. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. In 2026 the exemption is predicted drop to about 6600000 per person. Some taxpayers made transfers usually to.

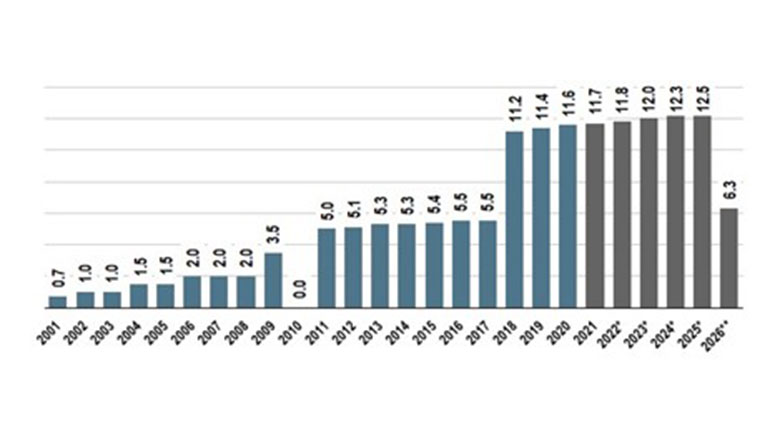

When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. A married couple can give away twice that amount. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans. As of January 1 2022 that will be cut in half. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans. This election is made on a timely filed estate tax return for the decedent with.

11700000 in 2021 and 12060000 in 2022. Get information on how the estate tax may apply to your taxable estate at your death. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It. The effective date of these tax rates and the tax bracket is January 1 2022. However the change to the top capital gains rate which is increased to 25 is effective beginning after September.

The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non-operating businesses and. Here is what you need to know. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022.

Lower Estate Tax Exemption. What is the transfer tax exemption for 2022. The new exemption amount would be 5 million indexed for inflation dating back to 2010.

7 million for couples accelerating the TCJA sunset date to early 2022. Some taxpayers made transfers usually to. No increase in the estate gift tax rate has been proposed nor has a reduction in the current 117 million allowance been proposed.

Effective January 1 2022 the exemption increases to 12060000. The estate tax exemption is adjusted for inflation every year. Increase the top rate to 396 beginning in 2023.

The exemption will increase with inflation to approximately 12060000 per person in 2022. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for inflation. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. However the 117 million allowance is already scheduled to be cut in.

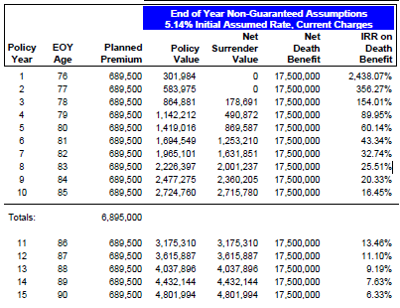

The federal estate tax exemption for 2022 is 1206 million. Proposed Estate Tax Exemption Changes. If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate.

Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. Ad From Fisher Investments 40 years managing money and helping thousands of families. The Proposed Regulations provide an exemption from the favorable treatment provided in the Anti-Clawback Regulations under Section 202010-1c for certain completed gifts that are included in the donors taxable estate or treated as includible in the gross estate for purposes of Section 2001b.

When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. With inflation this may land somewhere around 6 million. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. The size of the estate tax exemption meant that a mere 01 of. These changes may impact you if you have a taxable estate.

The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. The top rate would apply to taxable income over. Previously this reduction was not scheduled to take place until January 1 2026.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Reducing the Estate and Gift Tax Exemption Limit. The generation-skipping transfer tax GST tax exemption amount will also decrease from 117 Million per person to 5 Million per person.

The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as.

The proposals would also see the top tax rate increase to 45 from 40. The current exemption limit for estate and gift taxes is 117 million 234 million for couples as provided by the TCJA. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026.

The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to. If enacted the current 117 million per person estate and gift tax exemption would be reduced to 602 million for 2022 based on current estimates.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025.

Biden Tax Plan And 2020 Year End Planning Opportunities

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

How Could We Reform The Estate Tax Tax Policy Center

A Simple Solution To The Estate Gift Tax Quandary Agency One

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

How Could We Reform The Estate Tax Tax Policy Center

Estate Taxes Under Biden Administration May See Changes

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Biden Greenbook Estate Tax Proposals Should You Care

Estate Gift Tax Exemption Could Be Reduced By 50 Percent By 2022 Davis Miles Mcguire Gardner Pllc

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

A Grat Can Save You Millions In Estate Taxes Financial Samurai

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times